California Gov. Newsom Suspends Multi-Year Pension Contributions

- PAUL PRESTON

- Jul 13, 2025

- 2 min read

AENN

Jul 14 |

California Gov. Gavin Newsom is literally making payroll by negotiating with public employee unions for at least a two-year pension funding holiday, despite already facing at least $1 trillion in underfunded pension and other retirement liabilities.

The California State Legislature submitted its 2025-2026 budget on June 15th, the last day under law. Gov. Newsom then signed the budget on June 27th, the last day under law.

Despite overly optimistic revenue projections, the budget still projects at least a $12 billion deficit, violating the constitutionally mandated requirement for a balanced budget.

Mountain Top Times' Substack is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

The unions have agreed to at least a two-year nonpayment of what is referred to as “other post-employment benefit, or OPEB. This portion of the pension fund pays for lifetime retiree medical benefits. Unfortunately, it already has an $85 billion deficit.

To fund a future cost, retirement plans every year typically make an “annual required contribution,” or ARC. Over time, the annual contributions and returns on the invested capital funds are expected to compound at a high enough rate pay promised benefits. But failing to make the annual ARC, is the definition of “kicking the can down the road.”

There are three major sectors for California public Employee pensions. Even with extremely optimistic investment return expectation of 7.8% annualized without loss over the next 30 years.

The best case estimate for taxpayers current underfunding includes:

1) CalPers: covers 2 million public employees and has a $180 billion deficit;

2) CalSTRS: covers 1 million public teachers and has a $84 billion deficit; and

3) OPEB: covers medical care for 3 million and has an $85 billion deficit.

Adding this together, Mountain Top Times estimates that the best case under-funded pension liability is about $349 billion. Given there are about 13.43 million families in California, each California family is currently responsible for $25,987 of unfunded California public employee benefits.

The problem with the best case is that California public employee pension systems’ investment return over the last 20 years has been just 5.5%. In 2022, the pension funds not only failed to make the 7.8% projected return, but lost -7.5%, or about $30 billion.

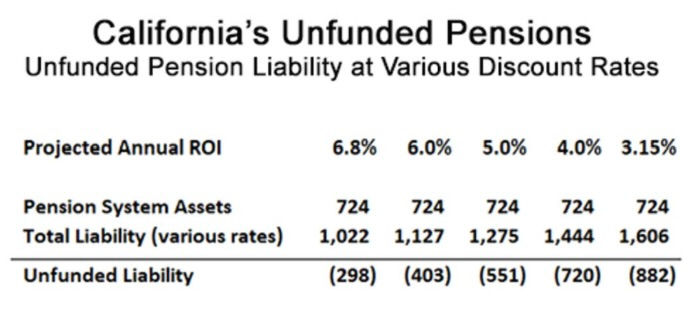

That $349 billion unfunded pension liability skyrockets as the pension fund investment returns fall, as shown below:.

In addition to violating the Constitution, the State of California has not filed an audited financial statement on time for the last seven years.

Gov. Newsom is trying to shift blame for these dicey financial numbers by blaming President Trump for deporting “undocumented workers” and causing a trade war.

But the Mountain Top Times reported that in May, the American economy added 543,000 U.S. born workers, and over 2 million jobs for U.S. born workers since Trump 47 took office on January 20th.

This news about California Governor Newsom suspending multi-year pension contributions is a striking policy development—it signals both fiscal caution and the tough balance leaders face between budget stability and social expectations. These kinds of decisions illustrate how thoughtful transparency and long-term planning matter deeply in public systems.

Just as responsible governance requires steady oversight and accountability, so does your household comfort. For dependable AC repair service in Borivali, go with certified professionals who deliver accurate diagnostics, clear pricing, and timely repairs—helping ensure your cooling system runs reliably and efficiently, keeping your environment consistently comfortable and well-managed.